Learn how to use the My First Nest Egg App to change your child’s mindset and turn “I want” into “I want to EARN.”

How to use My First Nest Egg to help you raise financially literate, happy, helpful children.

How 2020 Almost Broke Us

About two years ago, two besties were on a camping trip complaining about their financially illiterate kids.

These kids were pretty typical. They thought the magic card in mommy’s wallet could be exchanged for any and all goods or services.

They were confident that anything they wanted or needed could be found on Amazon and delivered for free in 1-2 days.

Finally, they knew that those paper bills they got in exchange for their extra chores were virtually useless and best deposited in laundry lint filters.

The year was 2020. Covid had just shut down the world. These moms were tired. They were homeschooling 7 kids between them in a “pod” (aka, a room where 7 kids gathered with 7 laptops, 3 pairs of working headphones, and repeated requests for clarification from their beleaguered teachers, and help from their frazzled mothers).

The moms were confident they could find some technology to help them solve the problem of their financially illiterate children.

Maybe they could even find a way to motivate their kids to participate more fully in household chores and remote school.

They were wrong.

Why a New App

Those moms were my co-founder, Nicolle, and me.

We went home from that camping trip and scoured the internet for something that would help us get a handle on our homes, which felt more out of control than ever.

We found lots of Apps and options, but none that were FUN and EASY (the former for the kids, the latter for us). And certainly, none truly put the wellness of kids first.

There are plenty of apps that let you create chore lists, behavior charts, and pay for chores. But many are connected to a debit card (all our kids were too young for debit cards), and none satisfied our two basic criteria (FUN and EASY).

So we decided to make our own App. How hard could it be?

(Did I mention we were in lockdown with 7 kids and barely maintaining our sanity?)

5 Ways to Use My First Nest Egg to Help Raise Financially Literate Kids

My First Nest Egg is different from every other App on the market.

Here are five features that make it truly stand out, and info on how to best utilize them for your family.

Easy to Download and Get Started

But before we get to the features, first things first: Downloading and Signing-Up for the My First Nest Egg App is EASY.

Unlike other apps which require a lot of personal information, banking information, and even a social security number, signing up with My First Nest Egg takes under 30 seconds. We ask for your name and email address. Then pick a password and be on your way.

The set-up wizard will prompt you to add kids, start with an earning puzzle (see below), and then give you a very brief overview of the accounts page.

That’s it – your account is ready to go!

1. Spend, Save, and Give Accounts

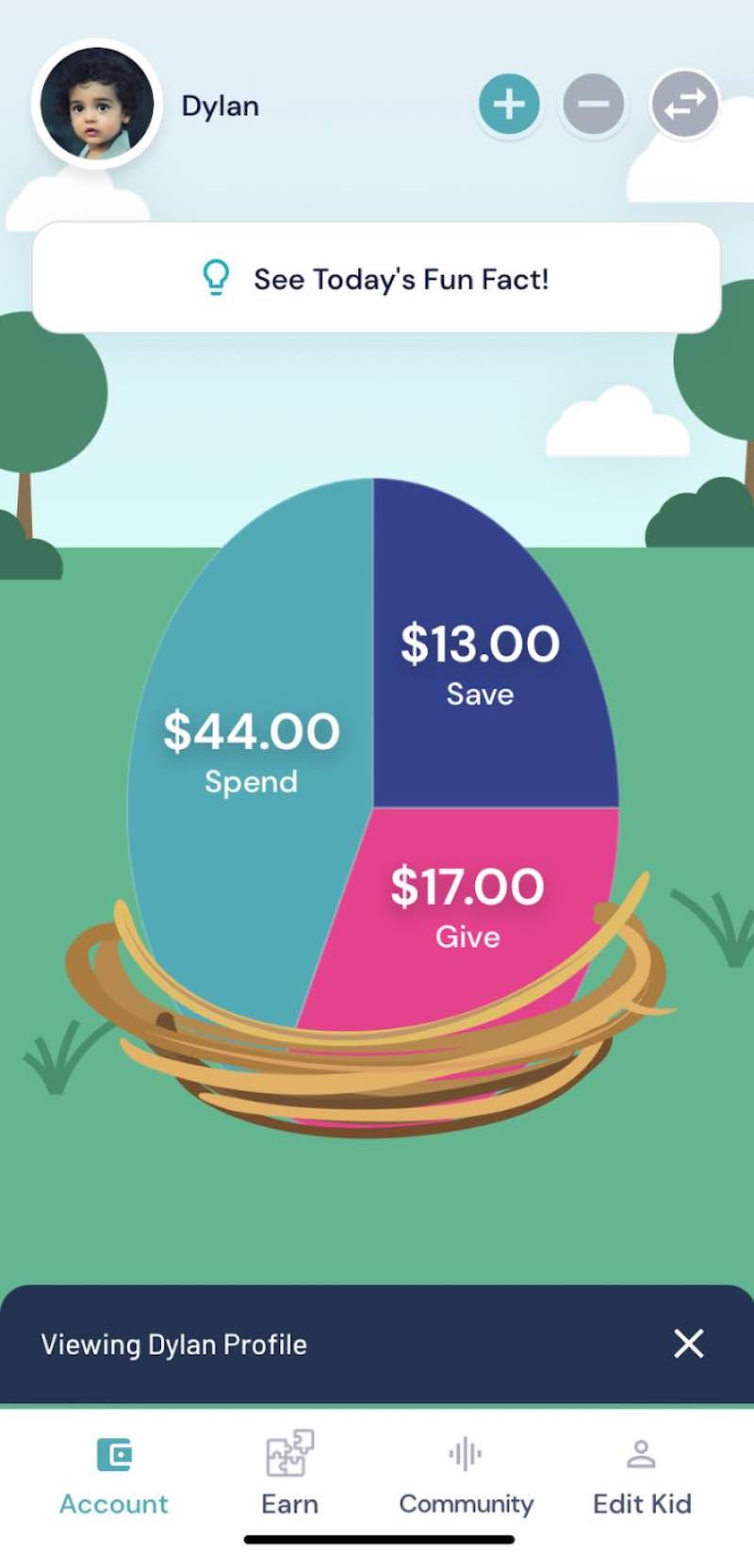

The backbone of financial literacy is understanding money, so we started with three virtual banks on our Accounts page.

All of the money in the accounts is virtual only – it is money owed to the child by mom and dad. It is easy to add, subtract and transfer.

This is the ideal way to track accounts for little kids who need to learn about money before they have access to any real money.

No Need for A Bank Connection

Let’s be real – the easiest way to spend money on and on behalf of little kids is via parent accounts.

Example 1: Does your child want to buy something on Amazon?

You simply buy it and subtract the money from your child’s virtual spend account.

Example 2: Your child donated a dollar to the Red Kettle Campaign?

You give them the dollar and transfer a dollar from their spend account into their give account.

Example 3: Do they want to save for a new skateboard?

You set up a savings goal in their save account and incrementally add money over time as they earn it.

There is no reason that these types of small money exchanges should require banking information or incur transaction fees.

Easy To Help Them Build Savings

This is a very easy way to teach kids about spending, saving, and giving without having to open an actual bank account. You can even set up automatic savings transfers so that every time you add money to their spend account, a percentage goes into savings.

This starts building a lifelong savings habit. If you would like to teach your child about interest and further encourage savings, you can set up automatic interest payments on money in their savings account to encourage that behavior as well.

Easy To Help Kids to be Generous and Give

We know kids love to be generous, but don’t always have money to give. We wanted to foster this generosity by not only tracking monetary donations but also tracking acts of kindness and community service hours.

You can award your child an act of kindness when you see them doing something kind, or they can request acts of kindness from their give account. Did you know that generous kids are 40% more likely to be happy?

No Need for a Piggy Bank

The App’s Account page takes the place of the outdated and underperforming piggy bank.

When a child puts money in a piggy bank, they cannot see how much is in the bank, cannot learn how to earn interest, and generally lose interest because it just sits on a shelf.

With the App kids can see how much money they have in each of their accounts anytime, and learn valuable lessons about spending, saving and giving.

RELATED ARTICLE: The 50/30/20 Rule for Kids Allowance

Track Chores Earning Puzzle Pieces

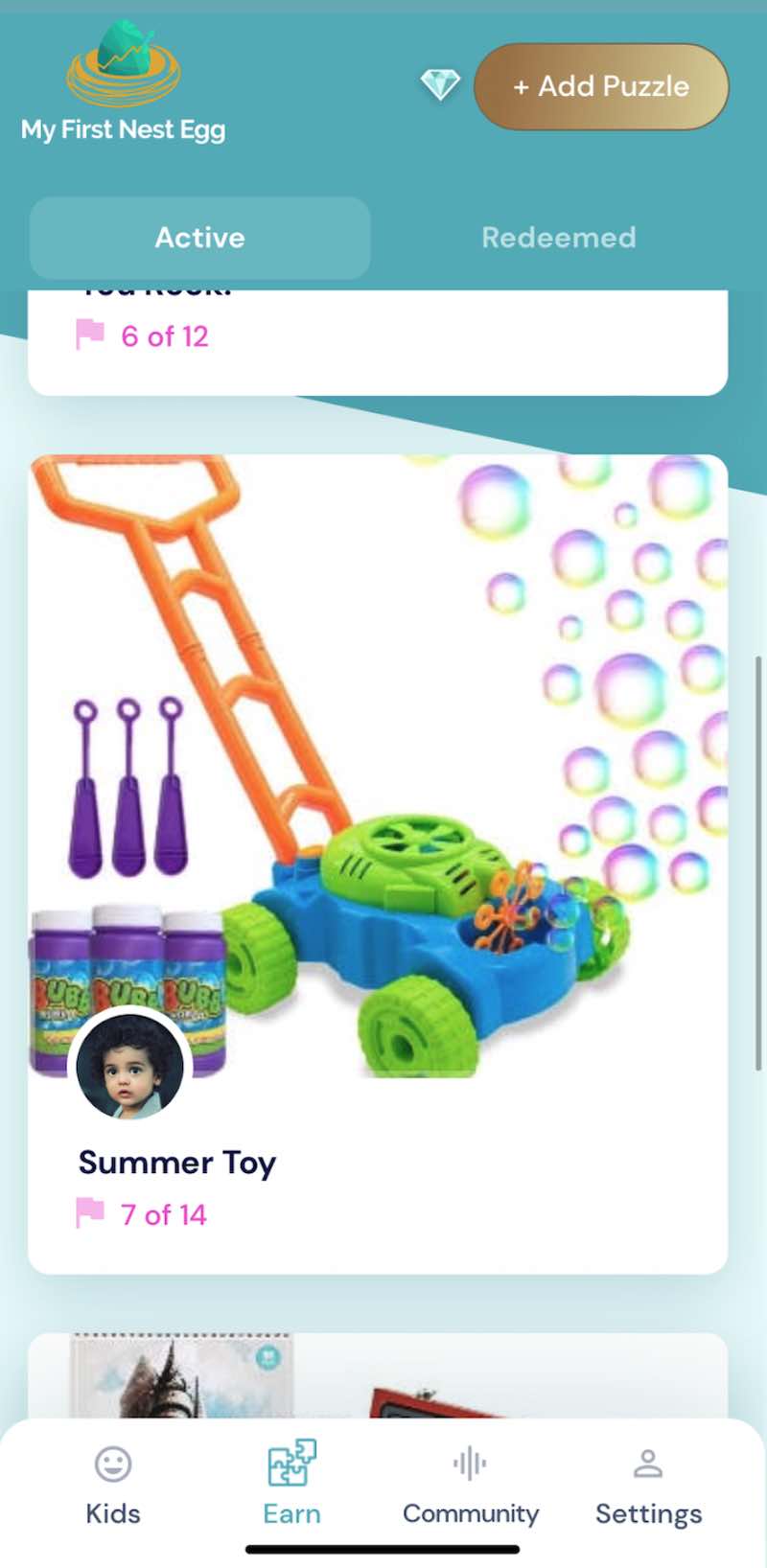

My First Nest Egg tracks chores with earning puzzles. Puzzles are the perfect medium to track chores for kids.

Once we started developing the idea it seemed like puzzles were invented for this purpose.

Kids love puzzles, and their benefits for children are well documented.

Puzzles increase self-esteem, encourage perseverance, and subtly teach delayed gratification. Puzzles are psychologically difficult to leave unfinished. Once you start a puzzle it practically begs to be completed – there is just something wrong about a puzzle that is still missing pieces. Most importantly, puzzles are fun.

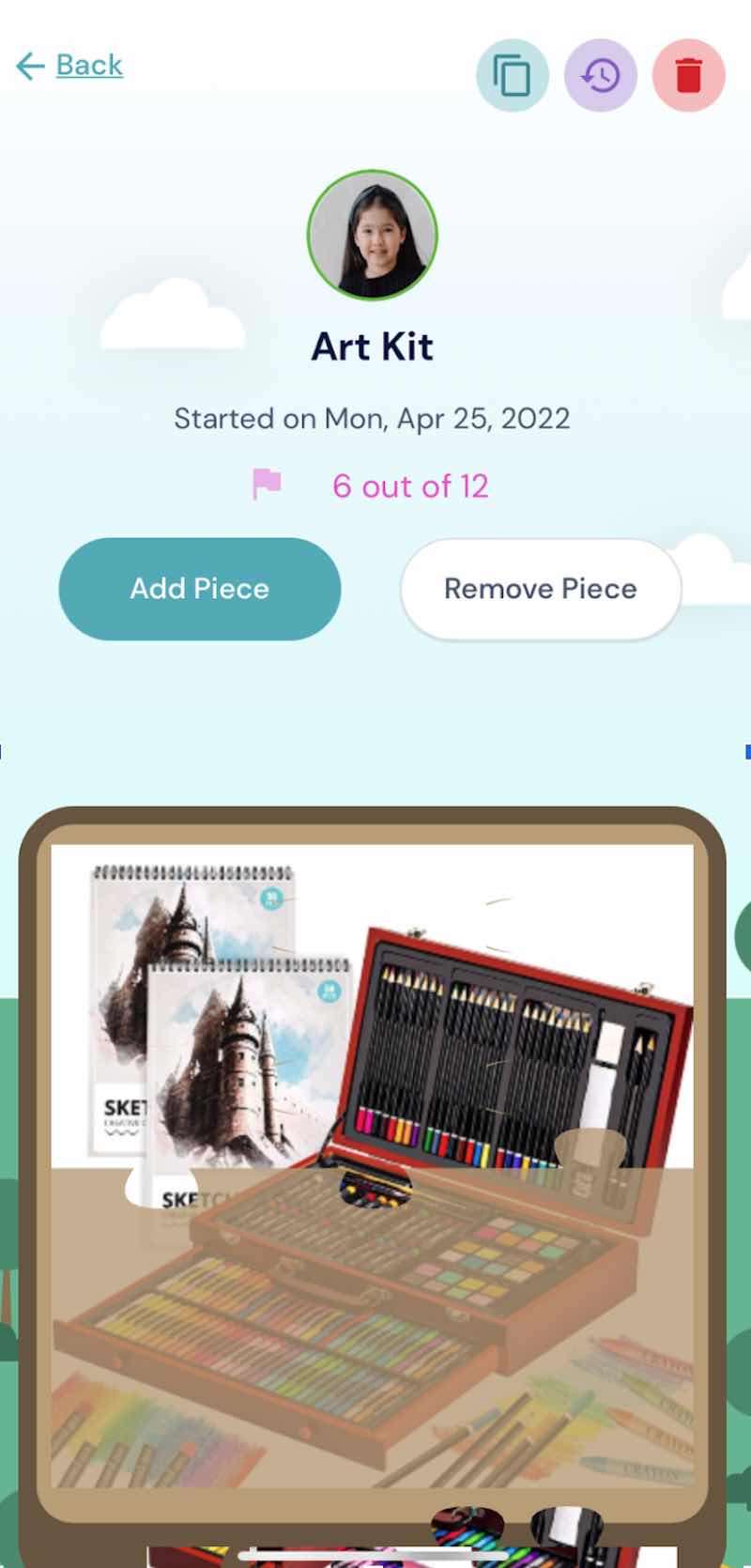

Our patent-pending puzzle system lets you take a picture of anything you want, or use a preselected picture. If your child is trying to earn a treat, doll, remote-controlled car, or allowance, you can simply take a picture of one or screen-shot a picture from the internet. Our system then lets you input chores you want your child to do to earn the reward. You can also choose from preselected lists of chores.

So, let’s say your child is attempting to earn a pair of goggles for the summer. You would put in a picture of goggles, designate the chores, and then the App will break the puzzle into however many pieces you choose. Every time your child completes a task, a piece is added to the puzzle. So if you wanted a 9-piece puzzle, your child would have to do 9 tasks to earn those goggles.

Every time they do a task, a piece is added and the puzzle comes together piece-by-piece. This not only works with items, it also works well for allowance money. The App allows you to put in an amount of money and automatically calculates what each piece is worth.

2. Patent-Pending Earning Puzzles

Kids are all very different. In order for these puzzles to work, it’s important to choose appropriate chores and an appropriate number of pieces. We discussed this extensively with Dr. Jennifer Gatt, Ph.D., an expert child psychologist and behaviorist, who has a comprehensive understanding of how to help and motivate children.

Dr. Gatt worked with us to create expert puzzles which come pre-populated with age-appropriate chores and puzzle sizes based on the age of the child. These are very easy to choose from, and you can easily add additional tasks and change the picture.

There are a variety of ways to use puzzles. One mom uses them to make her morning routine go more smoothly. She makes a daily puzzle (they are easy to replicate) with pieces all related to morning activities – brushing teeth, making the bed, putting on clothes, eating breakfast, and getting in the car on time.

Every day that puzzle is successfully completed without whining, her child receives a reward.

We have many users managing allowance with puzzles. The puzzle pieces are all extra tasks and when the puzzle is completed a set amount of money is transferred into the child’s spend account. We have children under 3 potty training on the app – a piece for each time they use the potty – and 12-year-olds earning the latest fashion trends babysitting their siblings. The puzzles work for everyone because they are completely customizable. My co-founder and I joke that these might even work on husbands….

The parents of young kids, who don’t understand money but need to understand earning, use the puzzles to teach their kids to earn things they don’t need but would normally be given. A new toy, a trip to an ice cream parlor, or a special playdate at a trampoline park. Most things cost money, and unless we consistently convey that message to children, they will be left with the mistaken impression that the things they want come without a cost.

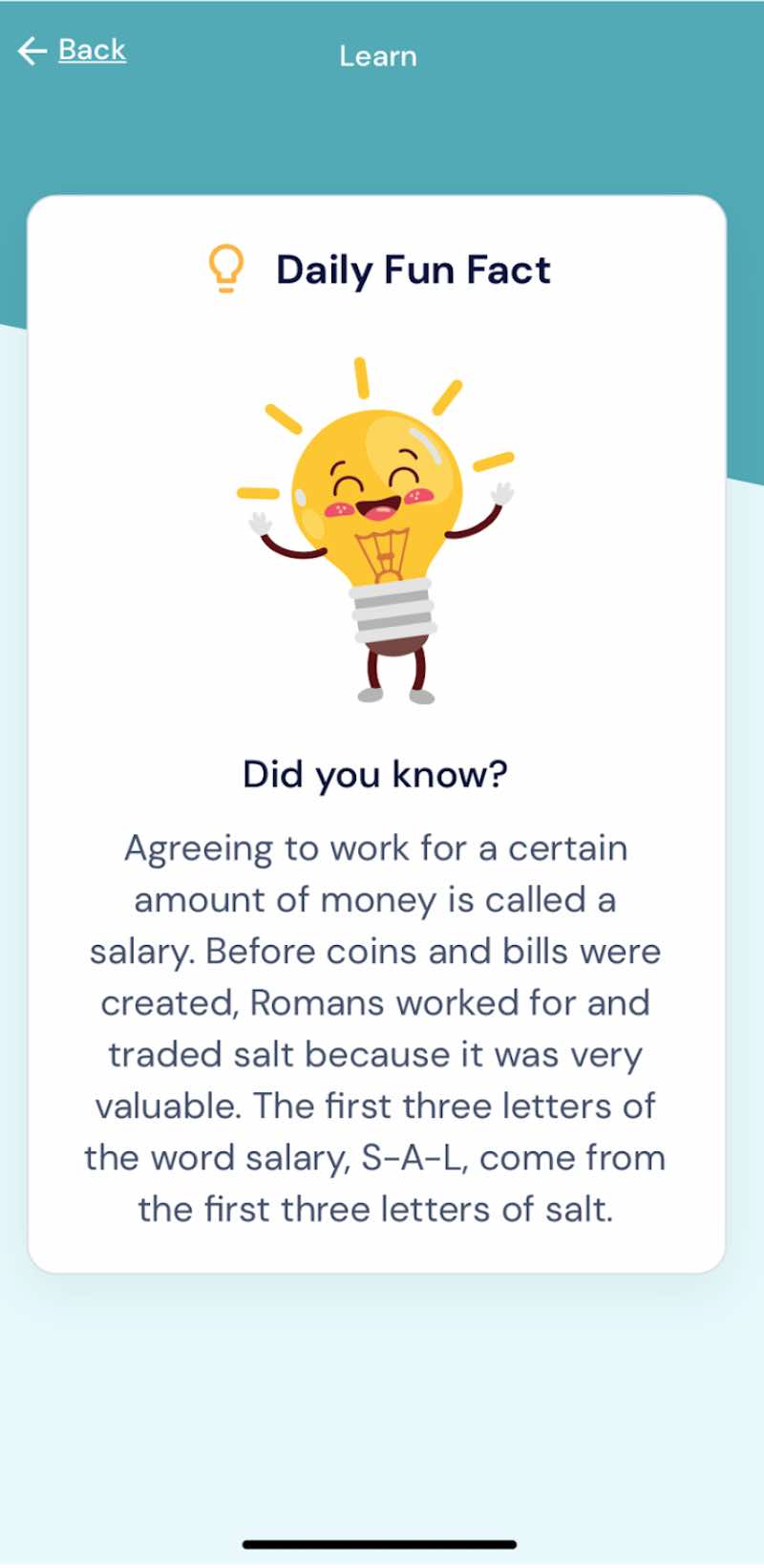

3. Fun Financial Facts

It is well known that schools get a low F when it comes to teaching our kids financial literacy. At My First Nest Egg, we believe this is a core curriculum component. We have worked with seasoned teachers and educators to create a curriculum for kids to receive a financial education, one day at a time. The financial fun fact is easy to access and fun for kids to learn.

Did you know? Agreeing to work for a certain amount of money is called a salary. Before coins and bills were created, Romans worked for and traded salt because it was very valuable. The first three letters of the word salary, S-A-L, come from the first three letters of salt.

By introducing these simple and fun concepts to kids in a way they can understand, we start them on their financial education path.

Our curriculum teaches economic fundamentals such as needs v. wants, basic financial terms, and the importance of interest.

Does your child know what inflation is? One user recently told his mom he needs to stock up on candy bars due to our current inflation situation. His dentist did not approve, but his parents were proud.

If kids are introduced to complex ideas in a way they can understand, they start to see examples of those concepts in the world around them.

44% of parents are extremely reluctant to talk to their kids about money. It is a topic that has become taboo, and the result is a catastrophic financial literacy crisis in one of the richest countries in the world. These fun facts start a conversation that can grow into financially literate kids.

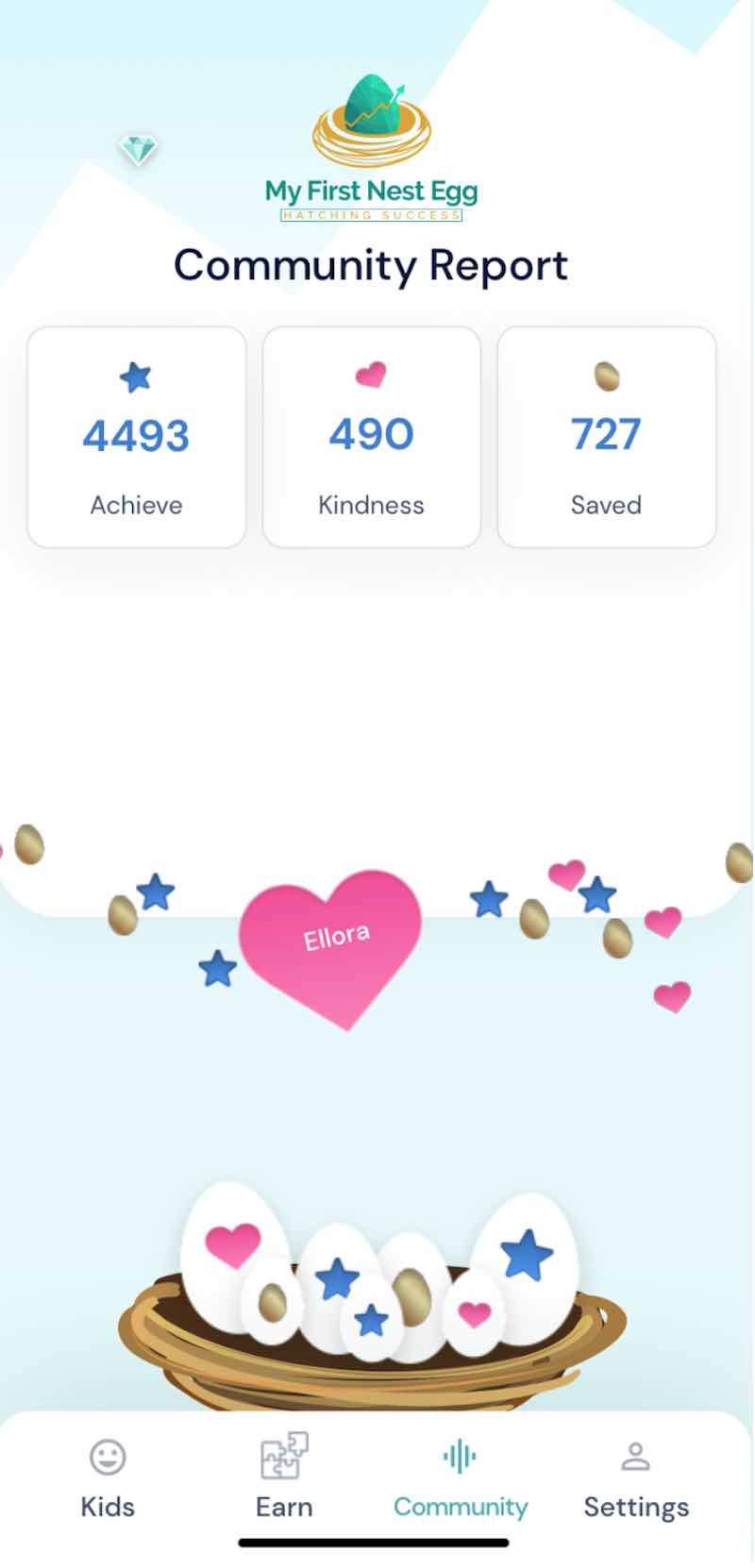

4. Community Page

Kids are motivated by other kids. As much as we nag, cajole, and beg our kids to do things, their peers seem to have an outsized influence on their behaviors. Have you ever suggested something to your child, only to have them politely ignore you? Then 10 minutes later one of their friends mentions it, and it’s the most genius idea they’ve ever heard.

At My First Nest Egg we wanted to harness some of that peer motivation to inspire kids to form healthy habits. We created the Community Page so kids can see their peers achieving, saving, and giving. This feature of the App can be opted-into or out of when you add or edit your children.

We value your privacy, so pictures are never displayed on the Community Page and you have the option to put in a nickname for your child.

The Community Page displays leaderboards that reset every month. There is the Achievement Leaderboard that tracks puzzle pieces – every time a child earns a piece they move up on the board. The Kindness Leaderboard tracks acts of kindness. The Savings Leaderboard tracks acts of saving, never amounts.

The Community Page lets kids show off their accomplishments to their peers and inspires them to also achieve, be kind, and save.

5. Kids’ View

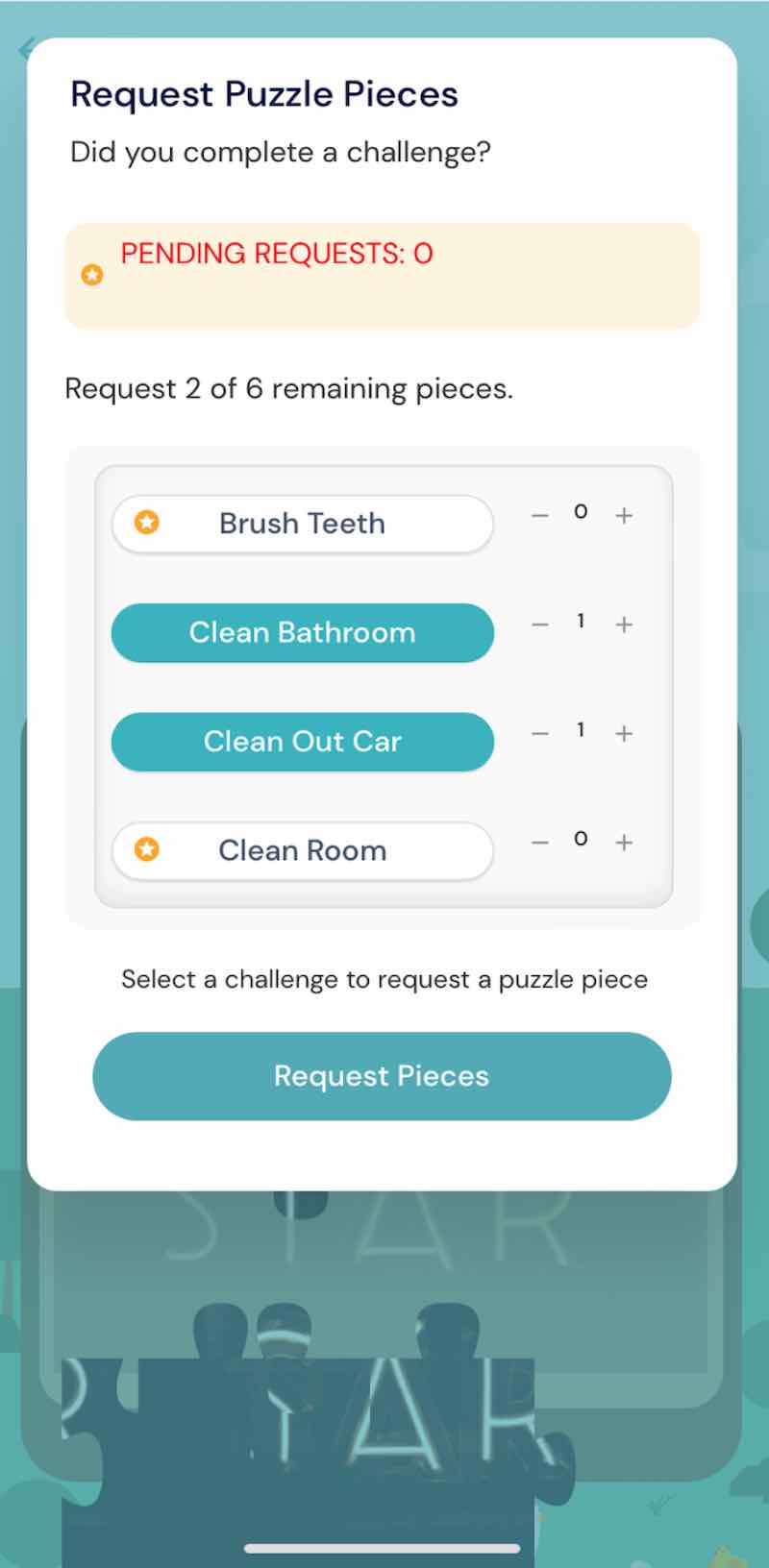

The view-only mode encourages kids to take ownership of their accounts and puzzles and makes it easier for parents to award pieces. When a child completes a chore and requests a piece, the parent is sent a push notification so they can review and either grant or deny the request. The same is true for acts of kindness – parents get the final say.

The App works perfectly well if you have a child without access to a tablet. However, if your child does have access to either an Android tablet or iPad, they can also have limited access to the App. Parents can download the App on their child’s tablet and log into the same account the parents’ use.

Once the App is downloaded the parent can put the App in view-only mode. This is a kid-friendly view of the App where your child can see all of their account info, monitor their puzzles, request puzzle pieces, and request recognition for acts of kindness. The child will not be able to exit view-only mode without a PIN set by their parents.

The view-only feature changed our lives. Once my kids could request puzzle pieces, they became much more excited and engaged in doing their chores.” Paul, Father of 4

Time to Get Started!

My First Nest Egg was founded by Moms. We built an allowance and chore App that is fun for kids and easy for parents while promoting financial literacy and the wellness of children. The App is free thanks to local sponsors. Sign-up today and start your kids on a path to a healthy financial future.